💸 Money matters

The financial inequalities that women face are still shocking in 2025 - so let’s talk about it…

Money isn’t really about pounds and pennies - it’s about power, freedom, and choice.

Every year, when the UK Budget rolls around, headlines scream about tax cuts, spending, and public services. But, behind those numbers sits something more personal. Budgets - national or individual - reflect what we value.

And for women, that story has never been even. We earn less, save less, and retire poorer. Not because we’re bad with money, but because the systems around us were never built with women in mind.

👉 This week, we’re looking at the inequality of finances for women and the conversations we all need to have to empower the next generation.

Hit subscribe and manage your subscription in Substack by ticking RISE to receive future issues of RISE by The Female Lead.

⚖️ The system isn’t built for women

Women’s financial inequality isn’t a glitch in the system - it is the system. From boardrooms, to break rooms, the numbers tell a story that hasn’t shifted enough. Women make up almost half of the UK workforce, yet fewer than one in ten FTSE 100 CEOs are female (Russell Reynolds Associates, 2024; CEIC Data, 2024).

The median pay for all employees was 12.8% less for women than for men in April 2025 and women are 50% more likely to be in low paid work than men. It was confirmed this year that the UK’s gender pay gap has been underestimated for more than 20 years. (ONS 2025, Living Wage Foundation)

After having their first child, a mother’s salary falls while men’s earnings continue to climb. And, much of the unpaid labour that keeps families (not to mention the economy) running still lands on women’s shoulders (ONS 2023, TUC 2023).

In the UK, men have £567 billion more invested than women and are twice as likely as women to have stocks and shares. Men also earn on average £260,000 more during their careers than women, which leaves them having 35% less in their pension pots by the time they retire (Centre for Sustainable Business 2025).

Resources

For teachers and educators

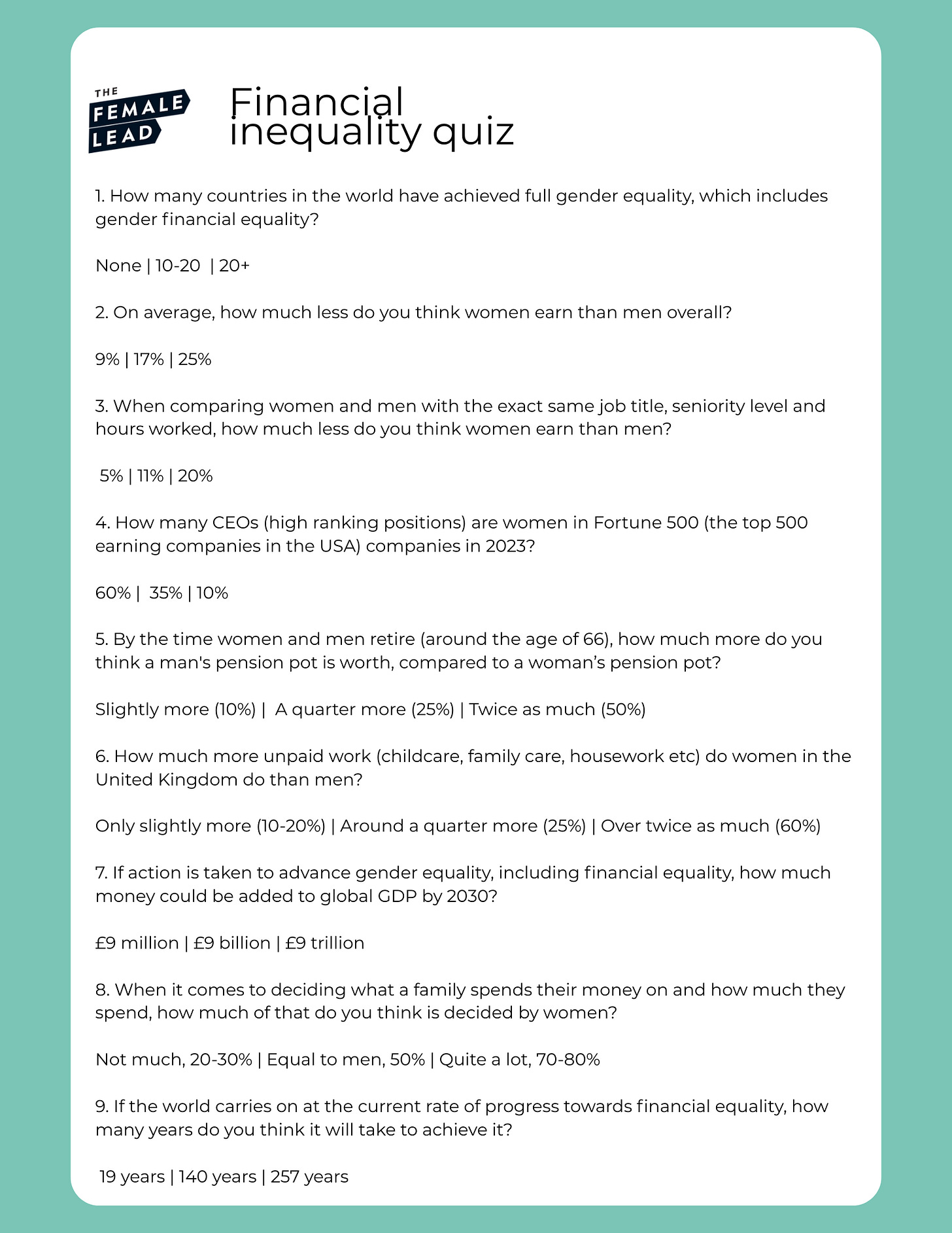

A financial equality quiz to do with your class that shines a light on how unbalanced men and women’s finances continue to be in 2025.

👉 Download our worksheet here:

For parents / guardians

👉 Money chat doesn’t have to be serious, but it should be part of our every day chats. Here are a few easy ways to start meaningful conversations about value, fairness, and financial confidence:

“When you think about money, what comes to mind first - saving, spending, or earning?”

“What’s something you think is worth spending money on, and what feels like a waste?”

“If someone gave you £100 to invest or save, what would you do with it and why?”

“When you imagine being an adult, what kind of relationship do you want with money - comfortable, adventurous, independent?”

“Have you started thinking about how you might make money in the future?”

The aim is to remind young people to consider what money means to them and empower them to make smart, ambitious decisions.

💷 What money means to me

“Too often women are left out of the financial conversations. To me, money equals power, not the power to control others but the quiet kind. The power to choose where you live, the power to leave a situation that’s no longer serving you, and the power to say yes and no, on your terms.”

What money means to YOU

“To me money equals freedom.” - Aleksandra

“Being able to afford stuff on my own without needing help was when I felt I had finally found my power. I still budget everyday though as the fear of losing it never goes away.” - Shaunie

“To me, money = unlimited choices and freedom to restart, whenever and wherever.” - Adriana

“Money = Choices” - Felicia

“Money means independence.” - Amaka

“Freedom, freedom, freedom.” - Ana Claudia

“Money means power, freedom, more enlightenment and opportunities.” - Ifumi

“Money can’t make you happy but it can facilitate things that make you happy like spending time with loved ones. Money gives you choices and an ability to help others. Money makes life easier.” - Gill

💰 Financial influencers to follow:

Abigail Foster - @abigailrosefoster

Laura Turner - @thriftylondoner

Pennies to Pounds - @penniestopoundspod

Ellie Austin-Williams - @thisgirltalksmoney

Clare Seal - Clare Seal

Hit subscribe and manage your subscription in Substack by ticking RISE to receive future issues of RISE by The Female Lead.

MAKE UP WHORES DONT